Analysis. Petrochemistry Globally

Risks for PKN ORLEN from sanctions on crude oil in UE

On May 3, 2022, Russian President Vladimir Putin signed a decree banning the export of Russian products and raw materials to selected entities, and the government is to present a register of people subject to sanctions within 10 days.

We believe that a Russian sanction on the sale of crude oil to Poland, Lithuania and the Czech Republic is probable. The sanction could be imposed in the coming days or – more likely – later as the markets get used to the new conditions.

From Putin's point of view, Russia has an effective mechanism for dividing European countries on the basis of their attitude to the war in Ukraine. Turning off the crude oil tap for Orlen is a message to the governments of other countries that they may face similar sanctions.

Putin can tell Orlen I am checking whether the company is prepared for a lack of oil supplies from Russia. As we know, ORLEN CEO Daniel Obajtek assures that he is well prepared. Unfortunately, the future may not look so great. German refineries, especially the PCK refinery in Schwedt/Oder, will gain a significant cost advantage in the event of sanctions imposed on ORLEN.

The Leuna refinery has announced that it will abandon Russian oil – although the exact timing of the resignation, as well as its durability, are unknown. However, due to the shareholder, TotalEnergis, everything indicates that the Leuna refinery will stop importing Russian oil (also thanks to supplies via the Polish Naftoport).

If the German refinery in Schwedt works on Russian crude oil, its sale may shift to the eastern direction, as it will not be in its "political" interest to compete with refineries located more to the west, which will most likely give up Russian oil.

In the event of Russian sanctions imposed on Orlen, the Schwedt refinery will gain a competitive advantage over the wholesale selling price of Orlen fuels. The Urals to Brent differential is enormous – in the order of $ 30-35 per barrel, Schwedt will have the opportunity to earn extra earnings on its eastern end by working at its full capacity.

Putin can show many countries: See how much you earn using Russian oil. This money will appeal to politicians and consumers.

On the other hand, the discontinuation of Russian oil sales to the Orlen group may not significantly increase the Urals/Brent price differential – which is already high enough to compensate for alternative (and extraordinary) transport costs. [This differential may be increased by the EU and US secondary sanctions on shipping oil by sea.]

What speaks for the imposition of Russian sanctions on ORLEN is also the supply of fuels from Poland to Ukraine. It is not in Russia's interest to support fuel supply in Ukraine. In addition, there is an aspect of logistics, the sudden cessation of crude oil supplies to Poland always causes tensions in the delivery schedule – contracts have to be concluded, ships have to come and not necessarily from the North Sea with Brent crude oil, other types of crude oil are more advantageous for Orlen. It should also be remembered that the Baltic Sea is a shallow sea and the Danish straits limit the tonnage of tankers – which of course increases costs.

Orlen shareholders should not be surprised when Russia says: you do not like our oil, we will help you make a decision. Unfortunately, Putin can play a short ball here.

The prospect of EU sanctions directly prompts Putin to take a step ahead, with the idea: if you want sanctions on oil in Europe, you have the opportunity to check how Orlen – which is supposed to be prepared for diversification – will cope.

The delivery of crude oil via the Druzhba pipeline to German refineries (in particular to Schwedt) and by ships to ports in northern Europe, with the simultaneous ban on selling crude oil to Poland, will put the Polish market under pressure from the wholesale supply of fuels from the west.

The differential at the level of $ 30 per barrel cannot be leveled in order not to lose the market/profit.

German refineries

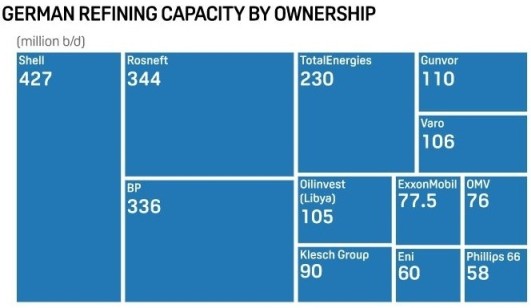

The vast majority of German refineries report the abandonment of purchasing Russian oil. The reason is purely business – the owners of these refineries are oil companies with a mining base. Shell has the largest share in the German crude oil processing market, with a capacity of 427 million b/d (barrels per day).

Source: S&P Global Platts

The second place is taken by Rosneft 344 b/d (with 92% stake in the PCK refinery in Schwedt and minority stakes in several other crude oil processing companies). In this case, the owners also support their own extraction base, but it is Russian oil.

The third player is BP (336 b/d), followed by TotalEnergis (230 b/d). The shareholders of German refineries are also Italian ENI, Austrian OMV, American ExxonMobile.

If we exclude Rosneft from the oil processing pie in Germany, then the three largest players (Shell, BP and TotalEnergis) have approx. 60% of such a limited market, and all shareholders of companies processing crude oil and having production capacity at the same time have at least 87%.

So it should come as no surprise that if we exclude Rosneft from voting on sanctions on oil from Russia, the other players will choose their own "Western" resources by voting with their feet. No EU sanctions were needed to restrict the import of Russian crude oil, and the mining companies sanctioned themselves in the name of supporting Ukraine and their own profits from the exploitation of the fields.

Individually, each of these companies/refiners would benefit from importing crude oil from Russia, but by entering into an unwritten agreement not to import crude oil from Russia, they buy "Western" oil from each other, and the German market accepts higher fuel prices resulting from such an agreement.

What will Schmidt choose?

Is the proverbial Schmidt interested in supporting Ukraine and paying higher bills or will he choose business as usual and lower inflation?

Germany has a different viewpoint, their media is a transmission belt for the government and for lobbying, including the pro-Russian one.

In Germany, the issue may soon be raised that the foreign owners of German refineries such as Shell, BP, TotalEnergis and ExxonMobile actually earn from sanctions on crude oil imports. Thanks to the purchases of their own "western" crude oil, they are pushing up its prices. And this is the price that German consumers are paying.

Refinery in Schwedt

At the end of April, Germany changed the law on energy security, allowing it to take control in the form of a trusteeship over critical infrastructure.

The PCK refinery in Schwedt may be placed under a trusteeship to adjust its operations in the event of the imposition of sanctions on the purchase of Russian oil.

However, the expected date for the introduction of EU sanctions is only the beginning of 2023. As the trusteeship has a duty to act in the best interests of the company, it should be expected that Russian oil will continue to flow to the Schwedt refinery for a long time to come.

It should also be borne in mind that the long deadlines for introducing the EU's ban on oil imports from Russia may approximate the end of the war and the resignation from sanctions ...

Crude oil supplies from Saudi Aramco to Orlen

Will contracts with Saudi Aramco or other suppliers be helpful for Orlen in terms of prices in the event of the conflict in Ukraine? Rather by no means, sellers' prices are at arm's length. Let us take the situation of Saudi Aramco even after taking over a stake in Lotos. Will Saudi Aramco be profitable to leave the "dollar on a barrel" at the parent company or in Lotos? The bill seems simple, leaving a dollar in the Lotos means a profit of 30 cents (Saudi Aramco's 30% equity stake in Lotos) less income tax and dividend tax.

Saudi Aramco and other oil sellers will secure supplies as much as possible, but at the market price. Moreover, a design where Saudi Aramco is both the ordering party and the seller gives it additional opportunities. It can regulate the price in such a way as to leave the proverbial „dollar on a barrel” in the parent company or in Lotos. And in the crude oil market, with different price formulas for contracts, variable freight prices, and differences in oil quality, it is not a problem to set the best price for an entity that de facto buys oil from itself. The margin of action not to be accused of transfer pricing is quite wide.

European or Russian sanctions?

As noted above, it is in Putin's interest to make a pre-emptive movement. Orlen shareholders should take into account the risk of Russia banning oil exports to Poland, the Czech Republic and Lithuania.

Moreover, it is possible that even after the end of the war in Ukraine and Russia's agreement with the West, Putin may order Russian companies not to conclude contracts for the supply of crude oil to Orlen. A possible reverse of Russian crude oil supplies could be prevented by the fact that it would be in the interest of the refineries in Leuna and Schwedt that good relations with a Russian supplier would be able to adjust the sales volume to the processing of German refineries. EU law on the free flow of raw materials, almost the reverse, in the case of oil supplies via the Druzhba pipeline, may be dead – because no one will order Russian entities to increase the sales volume.

European petrochemicals sensitive to sanctions

Petrochemical production in Europe exceeds the absorption of the internal market, approximately 20% of petrochemical products are exported. What is worse, the previous optimistic forecasts for the development of world petrochemicals are being revised due to a new trend – bad plastic. Ecology and health can remodel plastic consumption in developed countries. Plastic bags are the tip of the iceberg, from the health point of view, contact between food and plastic is unfavorable. This applies not only to PET bottles but the entire range of packaging, including apparently non-plastic tetrapacks in which the lining layer in contact with the product is foil (e.g. milk in cartons).

The bad plastic trend is growing and may catch up with the CO 2 fight.

GlobalData analysis shows that global petrochemical product manufacturing capacity is expected to increase by more than 40% over the decade, most notably in China and India – which are already industry leaders, followed by Iran, Russia and the US. A significant part of the projects was initiated during the period of global prosperity.

Leaving aside the issues of trends, the European petrochemical market is sensitive to the price of the raw material in a situation where crude oil was much cheaper in another region of the world.

China imports approximately 440 million tonnes of crude oil annually by sea, of which Russian oil imports approximately 1/10, or 40 million tonnes. China also imports Russian crude oil via the ESPO pipeline, and can import crude oil via Kazakh pipelines.

Approx. 120 million tons are supplied to the EU market from Russia (until the war in Ukraine).

The comparison of the above figures shows that China can technically accept all the crude oil that has been placed on the EU market so far. China may reduce the purchases of more expensive Arabian crude oil for Russian. This more expensive Arabian crude oil will, in turn, go to Europe.

A certain limitation for Russian crude oil exports may be the reloading capacity of Russian ports and the efficiency of transmission pipelines after the northern and southern arms of the Druzhba system are shut down. However, these would be difficulties that would slightly reduce exports from Russia (an estimated from a few to dozen percent of the volume so far directed to the West).

In practice, the greatest limitation may be the secondary sanctions imposed by the US and the EU on crude oil trade by sea. The replacement by Russia of crude oil exports from the West to the East would require approximately 200 units per large VLCC tanker (which is a quarter of the global state). These are tankers which, in the case of crude oil exports from the Baltic ports, would require topping up in the North Sea in the STS (ship-to-ship) system due to the limitations in the draft of ships in the Danish straits.

India as well as other Asian countries and African may also be a destination for Russian crude oil.

It should also be borne in mind that the greater Russia's problems with crude oil exports, the greater the Urals/Brent price differential. With a differential of $ 35 per barrel, a rail tanker carrying 50 tonnes of oil translates into almost $ 13,000 lower the price for that amount of the oil. Such a relation will certainly increase crude oil rail transport with countries bordering Russia in the south, including China.

Russia can use a flexible price for rail transport, taking into account the transport costs of the given transits.

Let's go back to the main story. European petrochemical production may be exposed to competition from Asian plants, which were already competitive before the outbreak of the war in Ukraine.

Asia will compete not only for semi-finished products such as ethylene, propylene, butadiene but for more processed products such as SBR rubber, ABS resin, latexes, polypropylene, polyethylene, PET, PVC, PS and ready-made consumer products such as tarpaulins, packaging films, parts of household appliances, chairs, ropes, etc.

It must also be said that Russia is one of the leaders in petrochemical production. And its products will greatly benefit from competitiveness, and the sanctions against Russia are unlikely to reach China or India.

The use of cheaper crude oil by petrochemical plants from China, India, Asia more broadly, but also from Russia, will lead to a significant deterioration of the competitiveness of European companies processing petrochemicals into consumer products, as a result, domestic demand for petrochemical products will be limited. The rating of European petrochemicals can be significantly degraded.

Shell, BP, TotalEnergis will be able to lose on petrochemical margins in the face of strong competition from the Asian side, but then they will earn on relatively expensive crude oil.

ORLEN, with symbolic crude oil extraction, is exposed to the risk of a changing environment in the form of lower petrochemical margins, which will not be compensated by upstream.

In the case of Orlen, the problem may be not only the economic downturn and bad plastic, but also the situation when a significant part of the petrochemical market in the world will operate on cheaper raw materials.

In the short term, possible Russian sanctions may hit ORLEN, which will lose its geographic rent to German, Slovak and Hungarian refineries.

Long-term EU sanctions (and in the even longer term potentially Russian sanctions) may lead to low the Orlen petrochemical margins. The construction of a new petrochemical plant – the "Olefiny III" (Olefins III) in a situation where the company has a trace of crude oil production, is burdened with a high risk. Fuels can be sold to consumers in the market that has monopolistic features, petrochemical products no longer depend so much on the distance between the buyer and the producer. An investment in the Olefins III may begin to lower the rating of the Orlen group.

Arabic-Chinese games

China imports crude oil mainly from Saudi Arabia and Russia, followed by Iraq, Oman and African Angola.

Saudi Arabia and China are mutually dependent. In a situation of conflict in Ukraine and cheap Ural brand crude oil, China is the apple of the oil market's eyes.

China may or may not significantly increase the volume of crude oil imports from Russia. Saudi Arabia and other Arab countries, on the other hand, may be forced to sell some of their crude oil exports to China at a discount, as much as China could additionally import from Russia. It is an excellent situation for Arab states to take over some of Russia's existing shares in the oil market for a long time. For Saudi Arabia, selling a certain volume of crude oil at a discount to China is still great business. Discounted crude oil is currently valued at around $ 80 per barrel and is an additional sale from Saudi Arabia's point of view. Even if China does not increase purchases from Saudi Arabia, these purchases will increase significantly from Europe. It is important for Saudi Arabia that China should increase its purchases from Russia as little as possible.

For Saudi Arabia (Aramco), a good relationship with China (read not increasing oil imports from Russia) has a double benefit – higher crude oil rates and a surge in sales volumes. For such a state of Arabs, it is worth paying China a bonus in the form of a lower prices, even for significant volumes of crude oil supplied.

From China's point of view, the balance must be favorable – they will pay less for oil than Western countries. The West is irritating, as shown by the NOPEC initiative, but in real terms, the West has no major influence on Saudi Arabia's oil trade policy, it will not even check the price at which the Arabs supply crude oil to China, which may also be used by settling transactions in yuan. Moreover, Saudi Arabia, from a broader perspective, can always turn to China in terms of trade, so the US pressure will not be particularly strong or effective.

In the report summary, in any probable scenario, Chinese petrochemical plants will obtain cheaper crude oil than Western countries – which is of particular importance for those Western refining and petrochemical companies that do not have a well-developed upstream leg and will not compensate for the high crude oil prices resulting from the situation in Ukraine by their own extraction.

Jaroslaw Suplacz